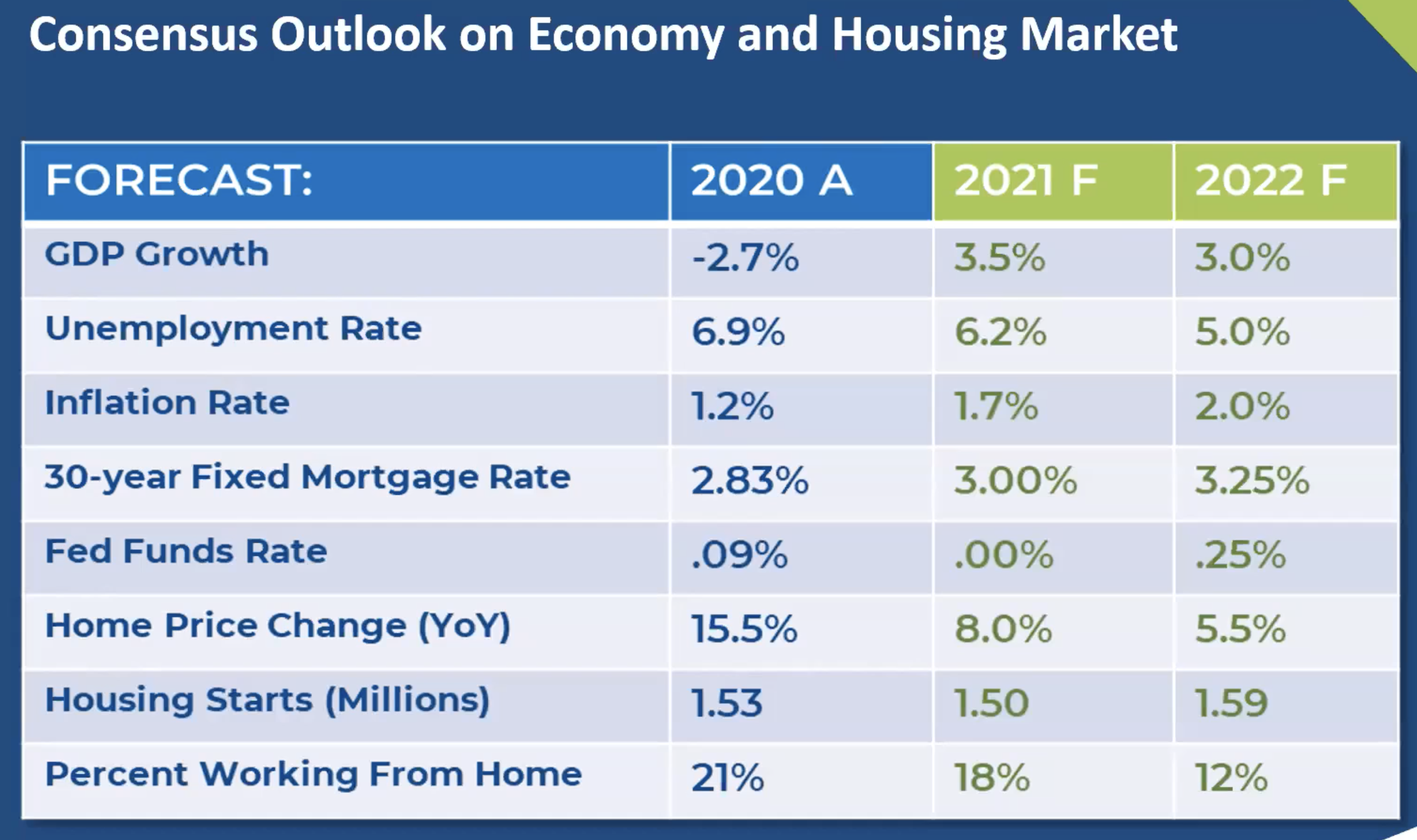

Thirty top economics came together for the NAR 2020 Economic Summit to give their predictions for 2021.

The Economy

Pre-pandemic, we had ten straight years of job creation, before losing 20 million jobs in April 2020. We lost the entire “jobs” gains in one month. All states reported job losses, except for Idaho. Nationwide jobs are down 6% from one year ago, after we hit a 50 year low in unemployment in February of 2020.

Consumer confidence is hovering around a benchmark of 100, which is considered neutral. Half of the population believe things are improving, half don’t. The wealth and strength of the housing market is helping homeowners to feel confident as they watch the value of their homes increase. We have seen record levels in equity for home owners. Consumer spending held up with help from those who kept their jobs, and the government stimulus propped up those who lost their job. The confidence will take a hit when the government stimulus runs out.

Those in the stock market are doing well. They aren’t feeling as big of a hit during the pandemic.

You are a big winner in this economy if you are a home-owner or you’re in the technology sector. When it comes to job security, the young and the old were hit the hardest. This could have far reaching impacts down the road in the housing sector, when these people don’t have the ability to purchase a home. Those in the travel and hospitality industries were the hardest hit.

The consensus is 2021 will turn out to see positive growth with help from the widespread vaccine. They do predict inflation to rise but not by much.

Real Estate

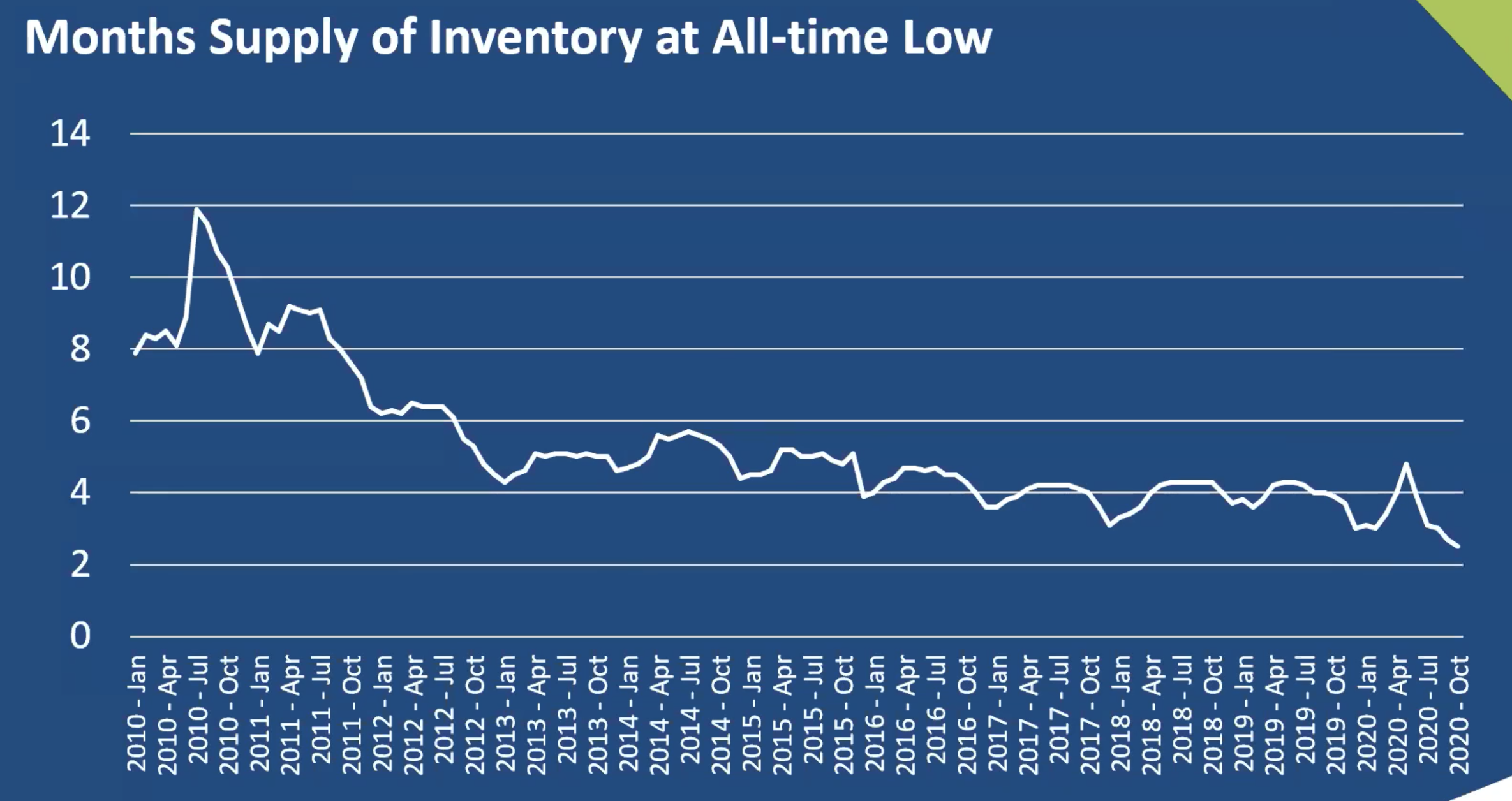

We are seeing the highest number of real estate agents ever recorded. They report they are keeping busiest with investors and iBuyers flooding capital in homes. This is one of the reasons home prices are soaring. The other reason is we are seeing low inventory and high demand across the nation.

Instead of going into assisted living centers, the elderly are staying in their homes, which is safer for them during the pandemic. This is another reason fewer homes are on the market.

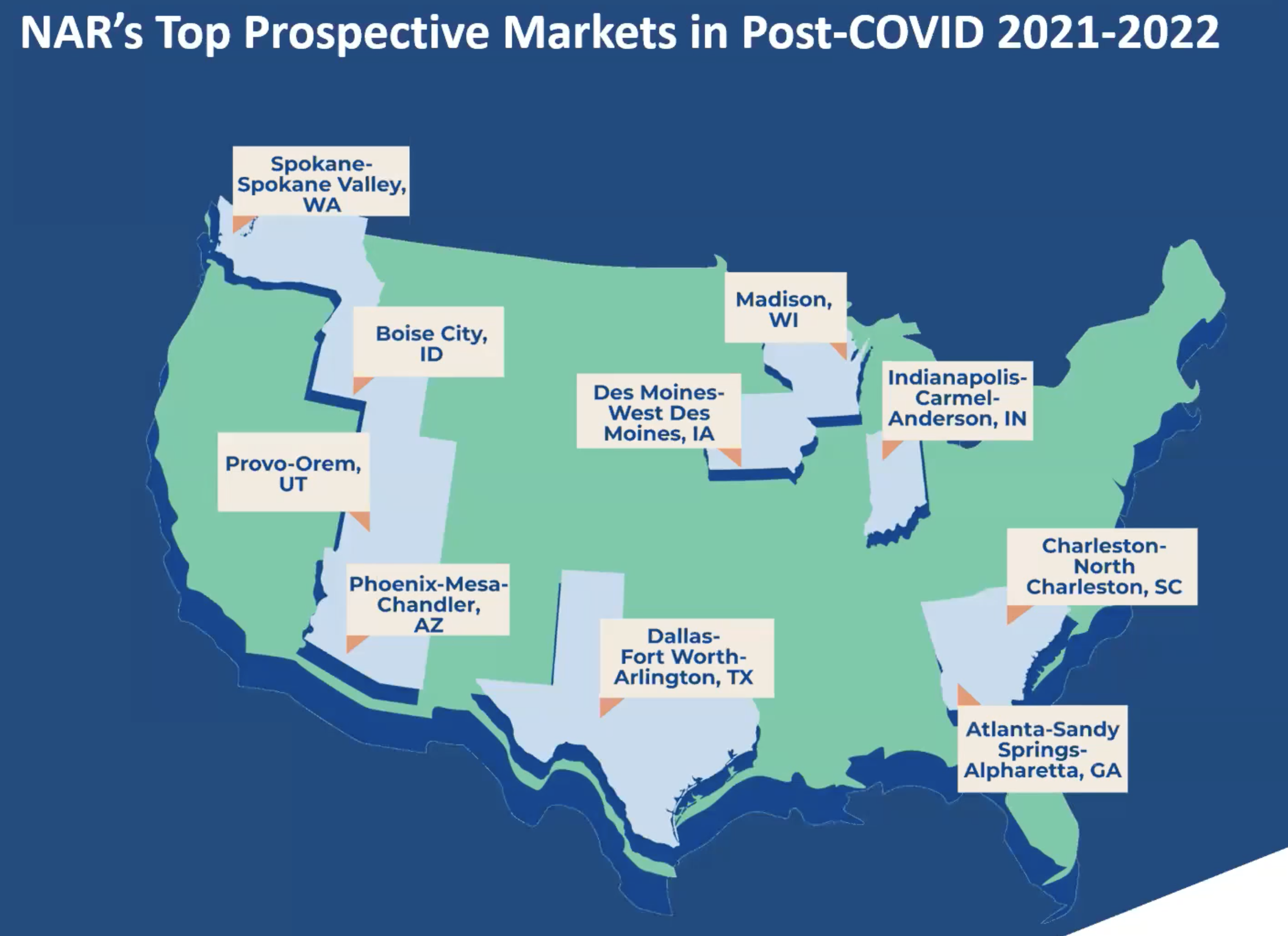

People living on the coasts are now working from home, and many of them are leaving the coast for places like Phoenix, Charlotte, Salt Lake City, Boise, and Seattle. Phoenix is seeing the greatest population growth.

(All graphs and pictures courtesy of NAR Chief Economist Lawrence Yun’s research)

There is a growing need for people who desire homes that allow for comfortable multigenerational living. Home buyers want space for their aging relatives to live with them.

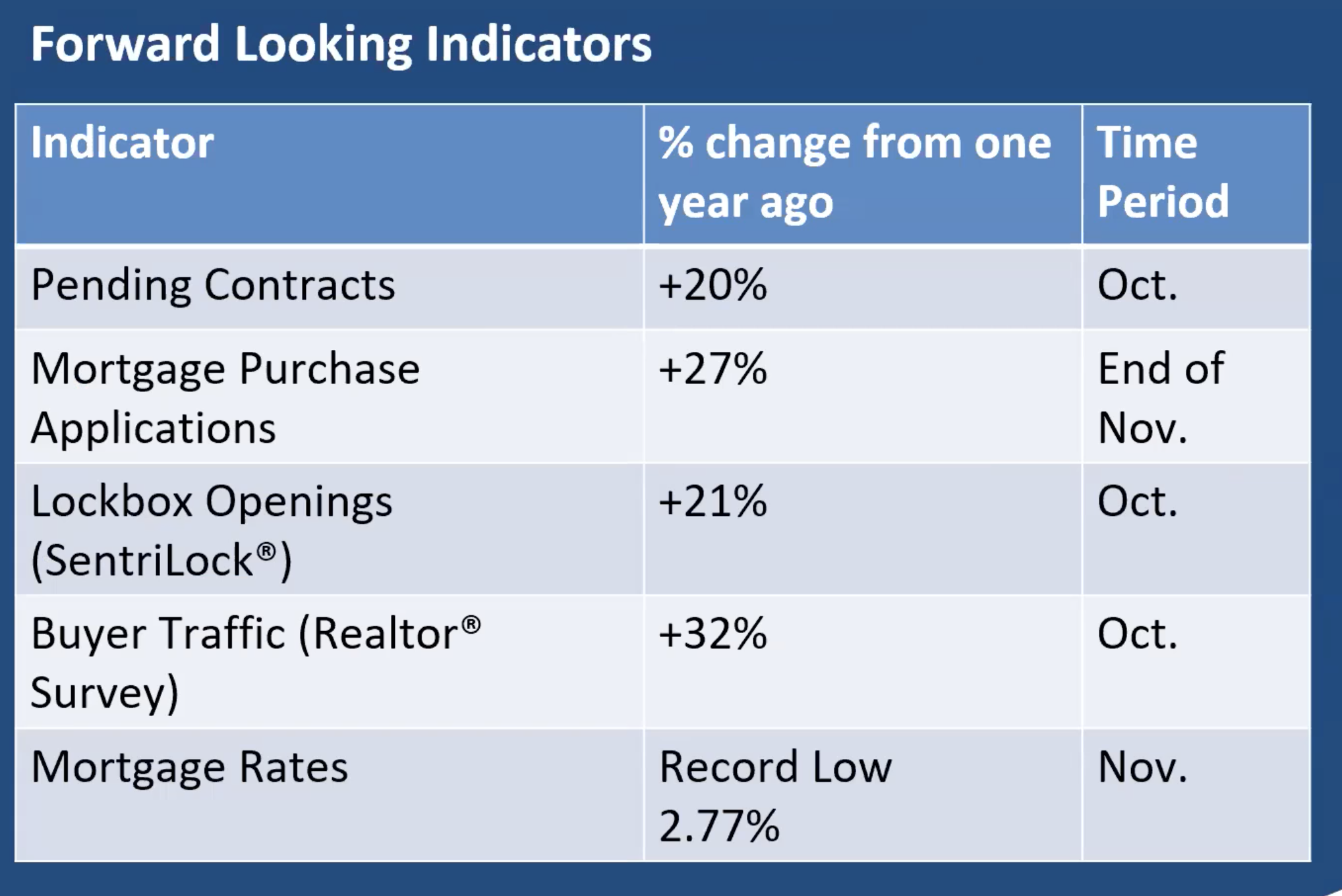

After the lockdown ended, there was a sales surge in homes beginning in the Summer of 2020. The winter season home sales are shaping up to be the best winter season home sales ever. Pending contracts up 20% from a year ago.

8% of mortgages are in forbearance. However, they don’t see foreclosures becoming an issue until 2022. Most banks are working with homeowners to modify their loans if they have missed payments. Their mortgages may go from 30 years to 31 years. Plus, there is such a demand for homes right now, homeowners could most likely sell their homes for top dollar instead of watching the bank take it from them.

The Challenges

“Affordable housing is one of the greatest challenges of our time, because the cost of homes is rising faster than people’s incomes,” Dr. Ben Carson, Secretary of Housing and Urban Development.

Lack of inventory is why home prices are rising so quickly, and those rising costs are making it extremely tough for first time home buyers. If the interest rates rise on top of the high prices, first time home buyers won’t be able to break into home ownership.

Supply chain issues, finding land, getting permits, and the tariffs on lumber increasing its cost, are the difficulties builders are hitting. However, Covid has shifted the demand into the suburbs, which makes finding land easier.

The Opportunities

As more people work from home, many will be able to leave their homes in urban areas to head more towards the suburbs. This mobilization will give agents opportunities for more business.

There is talk the Biden administration may address through tax breaks help for first time home buyers.

Keep an eye on what builders are doing as they work to increase building in areas that are becoming more desirable the more people have the flexibility to work from home.